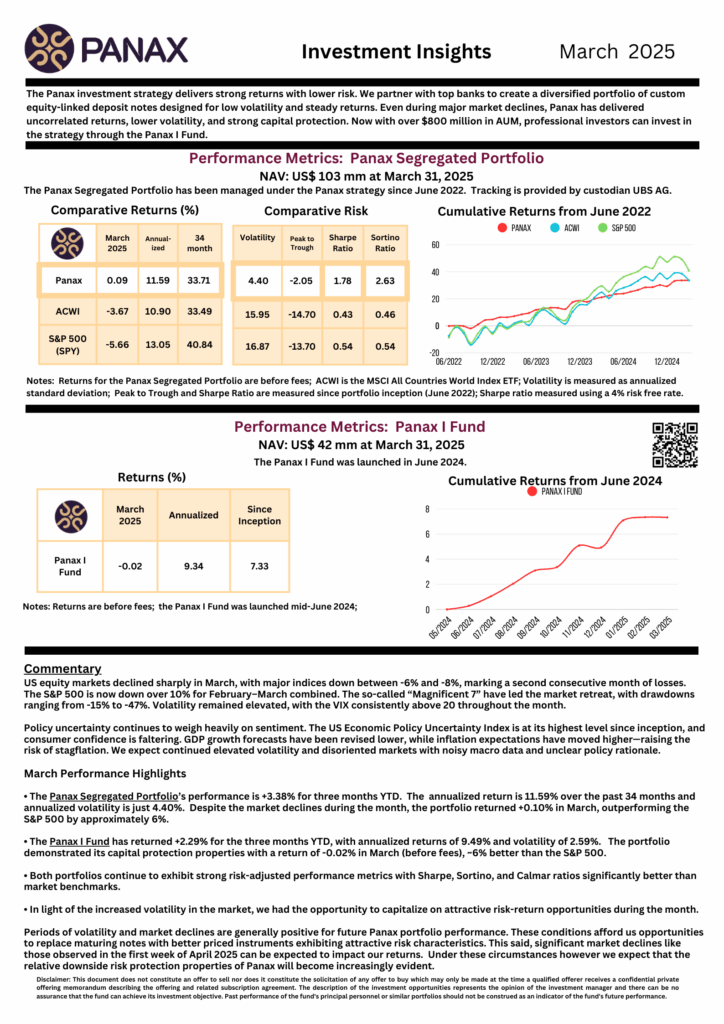

| Panax March 2025 Supplementary Comments |

| Capital Protection in Volatile Markets Our March 2025 performance commentary is provided above. With global markets experiencing high volatility, it’s timely to revisit the fundamentals of the Panax strategy—a capital-protective, defined-risk approach designed for today’s uncertainty. Defined Risk. Consistent Returns. Lower Volatility. Panax is built to generate steady, uncorrelated returns across market cycles, with risk budget targeting of no more than one-third the volatility of the S&P 500. We do not compromise our risk profile to chase yield. Our multi-layered risk assessments and disciplined investment process aim to be protective of capital and perform under stress. Portfolio Construction & Time DiversificationWe invest daily in equity-linked structured deposits tied to a curated list of broad, globally diversified ETFs.The strategy stays fully invested regardless of market conditions. Down markets often present attractive opportunities.The portfolio comprises over 400 deep out-of-the-money structured transactions, with an average maturity of ~9 months and a maximum of 12 months.Regular maturities and interest flows provide natural liquidity and repricing opportunities.Structuring enhances resilience and downside protection in volatile environments. Why Panax Belongs in Your Portfolio Panax is well-suited for investors looking to reduce portfolio risk without sacrificing return potential. It complements traditional strategies and offers superior risk-adjusted returns. |